|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Time to Refinance Home Loan: A Comprehensive GuideRefinancing your home loan can be a strategic financial move, but timing is everything. Understanding the best time to refinance can save you money and enhance your financial stability. Understanding RefinancingRefinancing involves replacing your current mortgage with a new one, usually to obtain better terms or interest rates. Why Consider Refinancing?

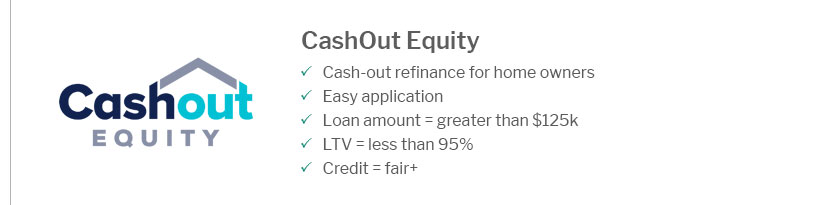

For more information on leveraging home equity, explore best online cash out refinance options available today. When is the Best Time to Refinance?Low-Interest Rate EnvironmentOne of the best times to refinance is during a low-interest rate environment. This can drastically reduce your overall mortgage costs. Improved Credit ScoreIf your credit score has improved since you took out your original mortgage, refinancing can help you qualify for better rates. End of Fixed Rate PeriodIf your current loan is an adjustable-rate mortgage, refinancing at the end of the fixed-rate period could prevent rate increases. Cost ConsiderationsRefinancing isn't free. Consider closing costs, which can range from 2% to 5% of the loan amount.

To find the best rate to refinance my home, compare offers from multiple lenders and consider all associated fees. FAQs About RefinancingWhat factors affect the decision to refinance?Several factors, including current interest rates, your credit score, loan terms, and closing costs, influence the decision to refinance. How does my credit score impact refinancing?A higher credit score can qualify you for lower interest rates, making refinancing more beneficial. Can I refinance with the same lender?Yes, refinancing with your current lender is possible, but it's wise to compare offers from other lenders to ensure you're getting the best deal. Refinancing your home loan is a significant decision that requires careful consideration of various factors. By understanding when and how to refinance, you can make informed choices that benefit your financial future. https://www.newsnationnow.com/business/your-money/should-refinance-your-mortgage/

The chance to refinance at a lower rate may be especially appealing for those who bought homes in 2023 when mortgage rates surged above 7%. https://www.usatoday.com/story/money/personalfinance/real-estate/2024/10/03/when-to-refinance-2024-mortgage-rates/75481034007/

A good rule of thumb is to take advantage of a refinance when you know you'll be able to break even on the closing costs in roughly two to three years. https://www.reddit.com/r/FirstTimeHomeBuyer/comments/17rrodh/if_rates_come_down_at_what_point_will_you_choose/

Refinancing early and often is not good advice. A mortgage is an amortization loan and most of the interest is paid up front. In some situations ...

|

|---|